- Keep Cool

- Posts

- Hot rocks: The IPO window opens

Hot rocks: The IPO window opens

Plus lots more across energy and sustainability circles

Hello,

Hope everyone in the path of the tremendous Winter storms in the U.S. is staying safe. I’ll be flying into the heart of it, back into NYC, on Wednesday, provided the planes are actually taking off. I’ll also be off to Portugal next week—if you call the Iberian peninsula home and want to link up, lmk and we might be able to get something going.

On to the news from the past week →

ONE STORY IN A SENTENCE AND A CHART

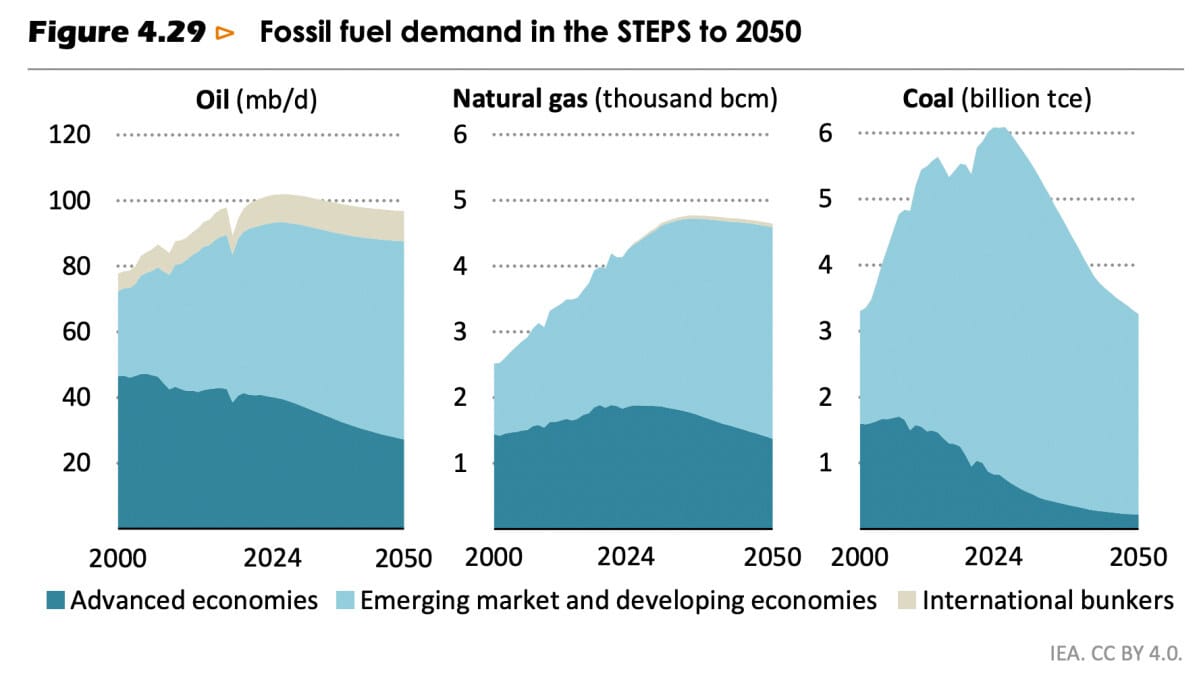

• I hadn’t had a chance to get through the World Energy Outlook report for 2025 from the IEA (published in November) until recently, but finally did and found their estimates for future fossil fuel demand striking, especially if oil and natural gas demand doesn’t fall faster than they project below, the world will be in considerable trouble. Link.

Note that in these IEA projections, even coal demand out to 2050 will only fall back to 2000 levels

NEWS, DATA, AND HEADLINES

• Fervo Energy, the splashy and well-funded next-generation geothermal startup, filed confidential papers with the SEC in preparation for an IPO following its $462 million Series E round last month. The IPO would mark a milestone for the geothermal industry and climate tech at large, which has seen few major exits in general, especially this decade. Questions remain about whether Fervo's enhanced geothermal approach, which leverages fracking technology, will be price-competitive and capable of scaling quickly and efficiently relative to other generation options amid rising energy demand. Link.

• Two other geothermal companies—Zanskar, based out of Salt Lake City, Utah, and Sage Geosystems, based out of Houston, Texas—raised $115 million in Series C funding (led by Spring Lane Capital) and a $97+ million Series B (co-led by Ormat Technologies and Carbon Direct Capital), respectively. Zanskar offers a suite of AI-enabled geothermal exploration and development systems and technologies. The company will also lead the construction of multiple geothermal power plants in the Western U.S., with a goal of energizing and delivering power before 2030. Sage Geosystems develops pressure-based enhanced geothermal systems for power generation and long-duration energy storage. P.S., this tweet from the Zanskar CEO is my favorite so far this year. Link. Link.

• General Fusion, a Canadian fusion developer founded in 2002, also plans to go public via a SPAC merger with Spring Valley Acquisition Corp. III at a $1 billion valuation. It plans to trade under the ticker GFUZ. The deal, expected to close sometime this summer, signals investor appetite for access to fusion companies but also hints at older fusion companies’ struggles to close private rounds. Link.

• Amazon acquired a shovel-ready 1.2 GW solar-plus-storage facility in Morrow County, Oregon, from bankrupt Pine Gate Renewables for $83 million. The Sunstone project marks a departure from Amazon's typical Power Purchase Agreement approach; here, Amazon will take direct ownership of renewable infrastructure amid ongoing disputes with Oregon utility PacifiCorp over promised power capacity. Construction is slated to begin this year, and the first 200 MW phase is slated to come online in November 2027. Link.

• Tokyo Electric Power Company brought Unit 6 of the Kashiwazaki Kariwa nuclear power station back online just 24 hours after pausing the restart due to an alarm malfunction, resolving the issue quickly. It then promptly shut the reactor down again promptly for an as-of-yet unspecified reason. Goes to show restarting major reactors ain’t that easy, which is an important reminder as several reactors in the U.S. are also slated for restart this year and/or next. Link.

• Verge Motorcycles claims to have produced solid-state batteries that store more energy, charge faster, last longer, and lower fire risk. Industry experts remain skeptical given previous unsubstantiated claims in the battery sector. If verified—particularly the lack of dependence on conflict minerals and lithium in the electrolytes—these advances could represent a significant breakthrough in energy storage technology. Link.

• New Jersey Governor Mikie Sherrill signed executive orders at her inauguration to freeze utility rate hikes, directed regulators to open solicitations for new solar and storage generation, and issued orders to modernize gas and nuclear facilities to lower long-term costs. Follow-through on the former will prove complicated and challenging, but will be an instructive test for other policymakers to watch. Link.

• Natural gas prices jumped more than 60% (depending on contract and region) ahead of major winter storms that are bringing freezing rain, heavy snow, and inclement conditions to many parts of the Midwest, East Coast, and South this week. That means ratepayer bills will continue to climb, as they already have in many parts of the company. Watch for infrastructure failures and blackouts as well. Stay safe out there! Link.

• The DOE’s rebranded Office of Energy Dominance Finance announced it is "restructuring, revising, or eliminating more than $83 billion in Green New Scam loans and conditional commitments" from the Biden administration's $104 billion portfolio. The agency eliminated an additional $9.5 billion in support for wind and solar projects, on top of past cancellations, and redirected funding to natural gas and nuclear energy. Specific affected projects have not yet been disclosed. Link.

• Three-quarters of the world's population—approximately 6.1 billion people—now live in countries where freshwater supplies are insecure or critically insecure, with 4 billion people expected to face severe water scarcity for at least one month annually, according to a new UN University report. Link.

• Just 32 fossil fuel companies were responsible for half of global carbon dioxide emissions in 2024, down from 36 in 2023, according to the latest Carbon Majors report (but still a striking stat). Saudi Aramco was the largest state-controlled polluter, while ExxonMobil was the largest investor-owned polluter. State-owned producers made up 17 of the top 20 emitters. Link.

• A massive illegal logging operation spanning 5,000 hectares of pristine forest in Indigenous Territory in Brazil's Pará state was uncovered last week. It delivered 25,000 cubic meters of timber to major U.S. and European buyers, including suppliers for Marriott hotels, Hyatt resorts, and Formula One VIP stands. Link.

• Zipline, an autonomous drone delivery company, raised more than $600 million at a $7.6 billion valuation and will expand operations to Houston and Phoenix in early 2026. The company just surpassed 2 million deliveries, including for medical supplies in Africa. Link.

• Terralayr, based out of Zug, Switzerland, raised ~$225 million across two equity tranches, led by Eurazeo, to develop and operate grid-scale battery energy storage systems and run its digital marketplace for trading flexible power capacity. Link.

• Cloover, based out of Stockholm, raised a $22 million Series A co-led by MMC Ventures and QED Investors to expand its embedded financing platform for homeowners and installers funding heat pumps, solar panels, batteries, and other climate tech home upgrades. The company also secured a $1.2 billion debt facility. Link.

• Jetson, based out of Vancouver, raised a $50 million Series A led by Eclipse to scale its all-electric heat pump installation business. Link.

• Divert, based out of West Concord, Massachusetts, secured new equity funding led by Wittington Investments to expand its anaerobic digestion facilities that transform unsold and otherwise wasted food into carbon-negative renewable energy, soil amendments, and fertilizers. New facilities in Longview, Washington, and Lexington, North Carolina, are expected to commence operations later this year. Link.

OPPORTUNITIES

Hiring

Daylight Infrastructure is hiring for two founding roles in San Francisco: a Founding Commercial Lead and a Founding AI Engineer.

The Commercial Lead will own offtake and PPA strategy, originate deals, and shape the GTM motion. It’s an ideal role for someone with commercial structuring or project finance experience who wants to build from zero to one hundred.

The AI Engineer will build the core intelligence layer: agentic workflows for contracting and diligence, data pipelines for grid/energy data, and tools that turn messy infrastructure reality into decision-grade insight.

Daylight is a market infrastructure company accelerating the commercialization of clean energy and industrial technologies. It aims to build AI-powered tools to automate diligence, structure deals, and help projects and buyers move from evaluation to signed agreements faster. The first vertical, Daylight Power, focuses on clean, reliable power for data centers—helping developers and operators assess power availability, diligence projects, and progress from site evaluation to signed agreements. The same platform will expand to other underinvested industrial inputs over time (SAF, cement, steel, etc.)

If you're motivated to build the next era of energy infrastructure and are energized to build from scratch, apply here.

Accelerators

Venture For ClimateTech (A program by NextCorps) is recruiting for its next cohort of innovators and climate tech founders working on solutions across: Buildings, Grid/Energy, Industry, and Transportation. The Accelerator program offers up to $50k in non-dilutive funding, mentoring and coaching, curriculum programming, investor intros, and a spot to pitch at NYC Climate Week! Apply here.

Best,

— Nick

Reply