- Keep Cool

- Posts

- Happy New Year

Happy New Year

Plus lots more across energy and sustainability circles

PRESENTED BY

Hey there,

Happy New Year. I’ve been easing back into the swing of things even as the newscycle has played fast and furious to kickstart 2026. With respect to what’s in my remit for climate, sustainability, and energy news from the past few weeks, you’ll find it summarized below. If you’re keen for something out of left field to accompany that, here’s a poem I published on the 1st. Nice to be back in the flow with some creative writing, too. Finally, if you call Seattle home, I’ll be in your city this week—let’s link up.

PRESENTED BY ERTHSEARCH

Fast + Accurate + Affordable CleanTech Recruiting | ErthSearch

New year, same great talent search team for cleantech companies. ErthSearch offers the antithesis of a traditional search firm experience for stellar cleantech companies. Their services are fast, they have deep access to exceptional cleantech talent, and they won't break your bank.

If you’re ready to grow your team and want a partner who will move at the speed and accuracy that you need at prices you can afford, reach out to ErthSearch today to get started. Book a call today or email them directly → [email protected].

To sweeten the deal, ErthSearch is also offering new clients who commit to 3 searches/retainers $5k off their first success fee. There are only 3 spots for this deal, however, and one is already taken. Offer valid for new commitments before Feb 1st. Book today.

ONE STORY IN A SENTENCE AND A CHART

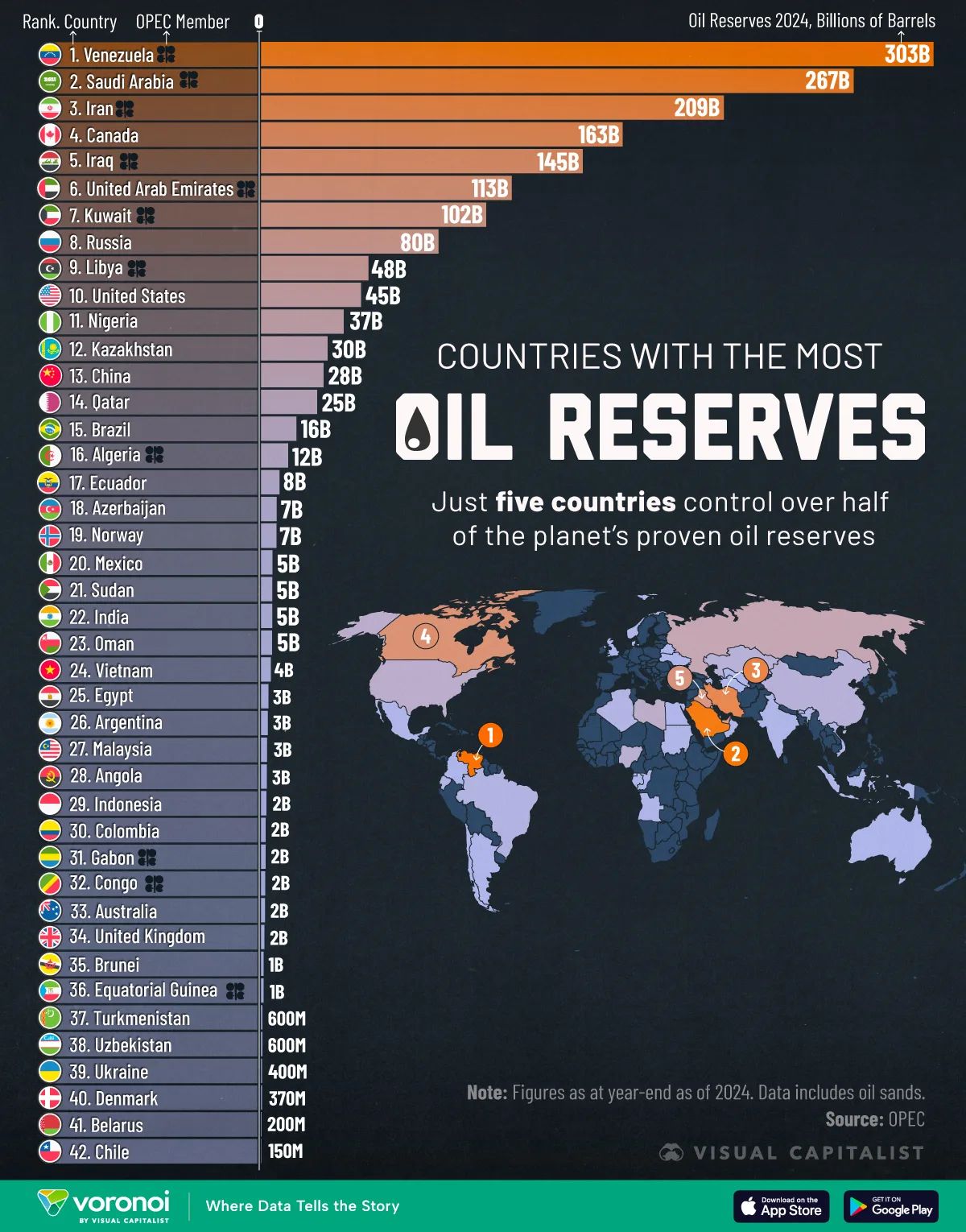

• Venezuela has the world’s largest proven oil reserves but vanishingly little to show for it in terms of current production; upping production would require decades of work and hundreds of billions in investment in a country with an uncertain rule of law and weak capital markets. Link.

NEWS, DATA, AND HEADLINES

• The U.S. Department of Energy announced $2.7 billion in awarded funding over 10 years for three companies tackling domestic uranium enrichment. American Centrifuge Operating, Orano Federal Services, and General Matter will each receive $900 million. funding aims to reduce reliance on Russia, which controls 44% of world uranium enrichment capacity, and boost production of high-assay low-enriched uranium for advanced reactors. Link.

• Tesla sold 1.79 million EVs globally in 2025, down 8% compared to the previous year and below rival BYD, making the Chinese automaker the world's top EV seller for the first time. This marks the second consecutive year of falling sales for Tesla. Link.

• Waymo announced its latest self-driving vehicle, the Zeekr-made Ojai van, which costs roughly $125,000 to produce compared to $195,000-$205,000 for its current fifth-generation Jaguar I-Pace vehicles. The sixth-generation system has half as many cameras and will roll out across Waymo's planned 20-plus markets this year. Link.

• Ford announced plans to introduce Level 3 autonomous driving systems to vehicles built on its new Louisville production platform by 2028, starting with a $30,000 midsize EV truck expected in 2027, though the autonomous features will cost extra. Link.

• Geely Auto's Xingyuan small electric hatchback became China's best-selling EV in the first half of 2025 with over 200,000 units sold, dethroning both the BYD Seagull and Tesla Model Y. The model starts at $9,700 and has sold nearly 430,000 units from January to November. Link.

• Solar arrays provided more power to Texas' grid in 2025 than coal-fired power plants for the first time, according to newly released data. Link.

• Sunrun formed a joint venture with green infrastructure investor HASI to finance the deployment of at least 300 megawatts of solar across more than 40,000 homes. HASI will invest $500 million over 18 months, allowing Sunrun to retain significant long-term ownership while bringing down installation costs. Link.

• The U.S. and Kazakhstan struck a nuclear cooperation deal that will see the US supply Almaty with a small modular reactor simulator as a potential precursor to U.S. involvement in building actual SMRs across Central Asia. Link.

• Duke Energy submitted its first site application with the US Nuclear Regulatory Commission for a new reactor in North Carolina. Link.

• South Korea's nuclear regulator approved a license for the long-delayed Saeul-3 reactor in Busan, marking nearly 10 years since the APR1400 reactor received its initial construction permit. Link.

• China is building at least 35 nuclear reactors, with the newest Hualong One reactor at the Zhangzhou nuclear station in Fujian Province starting commercial operation and construction beginning on two more CAP1000 reactors at separate southern plants. Link.

• Global climate tech investment grew in 2025 compared to the previous year, reaching $40.5 billion despite an 18% decline in deal count, indicating capital concentration in larger, growth-stage companies. Link.

• The Trump-affiliated TruthSocial parent company's merger partner, nuclear fusion developer TAE Technologies, announced site selection is underway for a pilot-scale 50 megawatt power plant set to begin construction later this year, with future plants expected to generate up to 500 megawatts. Link.

• Commonwealth Fusion Systems announced deals with Nvidia at CES 2026 and revealed it had installed the first magnet at its pilot reactor. Link.

• Nvidia CEO Jensen Huang also unveiled open-source AI models for autonomous vehicles at CES and announced the company's driver-assistance software will debut in the new Mercedes-Benz CLA later this year, enabling point-to-point hands-free driving on city streets. Link.

• Hydrostor's Willow Rock project received approval from the California Energy Commission to build a 500 megawatt compressed air energy storage facility capable of eight hours of discharge, totaling 4 gigawatt-hours. The project still needs to secure contracts for 200-250 megawatts of uncontracted capacity before construction can begin, with total costs estimated at $1.5 billion. Link.

• Copper prices reached a fresh record of $6.06 per pound as S&P Global forecasts a growing supply deficit that could reach 10 million metric tons by 2040, representing 25% of projected demand. Link.

• The anticipated restart of the Palisades nuclear power plant in western Michigan has been pushed back by four months to February or March 2026, delaying what would be the first commercial US reactor to fully restart after going offline. Link.

• The Trump administration announced via executive order that the US was withdrawing from 66 international organizations, including 31 under the UN, among them the Intergovernmental Panel on Climate Change and the UN Framework Convention on Climate Change. Link.

• General Motors recorded $7.1 billion in charges in its fourth-quarter results due in large part to is pull back from EVs. Link.

• Interior Secretary Doug Burgum announced a halt to all construction on offshore wind projects due to national security concerns, pausing leases for Vineyard Wind, Revolution Wind, Coastal Virginia Offshore Wind, Sunrise Wind, and Empire Wind. The move threatens to derail the bipartisan SPEED Act, a permitting reform bill, with key Senate Democrats calling it "dead in the water." Link.

• Getting Venezuela's oil production back to mid-2010s levels will require up to $110 billion in fresh investment, according to Rystad Energy, with major obstacles including ongoing legal disputes with ExxonMobil and ConocoPhillips, the country's heavy and sour crude being less valuable than light sweet varieties, and current oil prices at five-year lows. About 25% of Venezuela's gas output is also lost to the atmosphere, as the country features the highest flaring rate in the world and nearly 10 times above the global average, according to a satellite analysis published in Nature Communications. Link. Link.

• Scientists from Woods Hole Oceanographic Institution completed a five-day ocean alkalinity enhancement experiment in the Gulf of Maine, pumping 16,200 gallons of sodium hydroxide into the ocean to test a climate intervention that could simultaneously address global warming and ocean acidification. The experiment raised pH levels from 7.95 to 8.3 across a six-mile patch and confirmed carbon uptake from the atmosphere, though researchers are still working to quantify the exact flux. Link.

CURATED DEALS

Larger funding rounds:

• Alphabet acquired data center and energy infrastructure developer Intersect for $4.75 billion in cash plus assumed debt, building on Google's existing minority stake. The acquisition includes multiple gigawatts of energy and data center projects in development and will operate separately under the Intersect brand. Link.

• OpenAI and SoftBank jointly invested $1 billion in SB Energy, with each company contributing $500 million to support the infrastructure company's US data center buildout. OpenAI selected SB Energy to build and operate its 1.2 gigawatt data center in Milam County, Texas. Link.

• Kraken Technologies, an AI unit spun off from Octopus Energy that supplies energy billing and operations software to utility companies, raised $1 billion at an $8.65 billion post-money valuation from investors including an unnamed major customer, D1 Capital Partners, and Origin Energy. Link.

• Cylib, based out of Aachen, Germany, raised €63.4 million (~$74.2 million) in grant funding from the German Federal Ministry for Economic Affairs and Energy for its LFP battery recycling company. Link.

• Diginex, a London-based sustainability regulation tech provider, acquired carbon accounting startup Plan A for €55 million (~$64.4 million). Link.

• Venterra Group, based out of London, raised £40 million (~$53.8 million) from investors including General Atlantic, First Reserve, and Asfari for its renewable energy company that specializes in wind power. Link.

Medium-sized funding rounds:

• United Solar Holding, based out of Oman, raise $30 million from Waaree Solar Americas for a polysilicon manufacturing plant that will produce 100,000 tons annually once complete, making it the largest facility of its kind outside China. The plant will support 40 gigawatts of solar module production. Link.

• Array Labs, based out of Palo Alto, raised a $20 million Series A led by Catapult Ventures to develop radar satellites for three-dimensional Earth mapping. Link.

• BlueNalu, based out of San Diego, raised $11 million in equity funding co-led by Agronomics, Siddhi Capital, and Lewis & Clark AgriFood to grow bluefin tuna from fish cells. Link.

Smaller funding rounds:

• Filtrabit, based out of Oulu, Finland, raised a ~$2.3 million equity funding round led by Ajanta Innovations to develop modular dust extraction systems capturing industrial microparticles from gas streams. Link.

Have a great week ahead,

— Nick

Reply