- Keep Cool

- Posts

- DERs stay hot

DERs stay hot

Plus lots more across energy and sustainability circles

Hey there,

To kick off today's offerings, we have a very special offer from the minds behind DERVOS, an annual event that’s essentially Mecca for distributed energy resource (DER) enthusiasts. I had a fantastic time attending last year’s DERVOS, will be there again this year, and want you all to join me. To that end, the DERVOS team is offering 20% off tickets for the all-day event on October 17th on Governors Island in NYC to 25 of you who want in. Follow this link for more details and/or use code KEEP COOL GIVEAWAY to book.

ONE STORY IN A SENTENCE AND A CHART

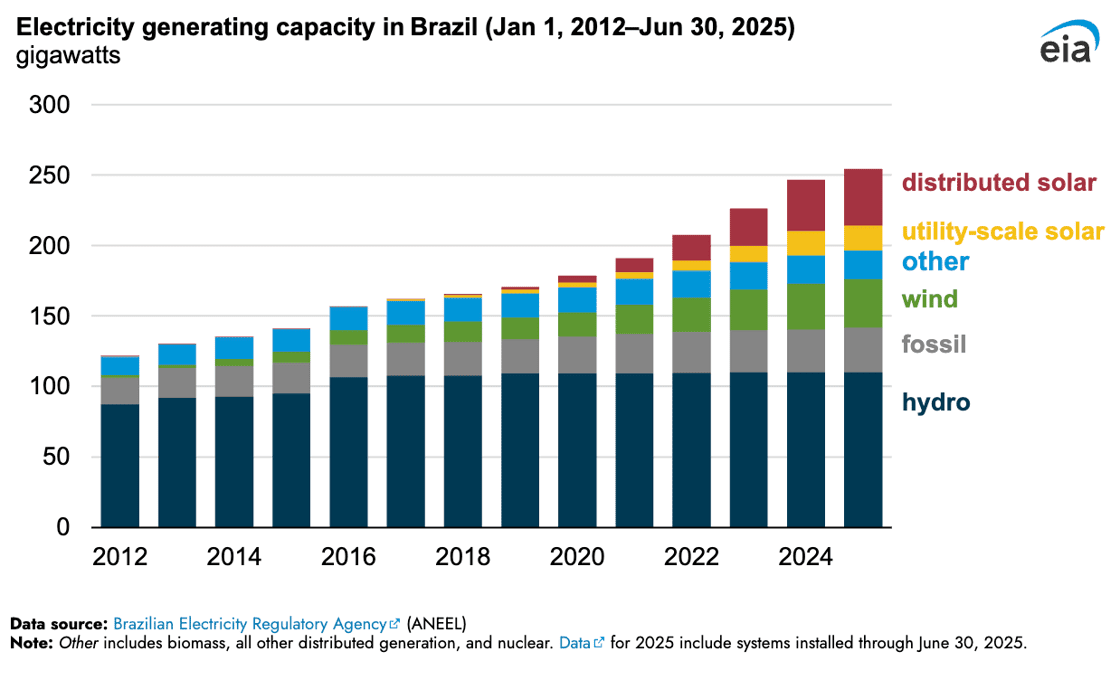

• In a year in which we’ve seen distributed solar installations take off in many countries ranging from Pakistan to Africa, we can now add Brazil to the list, too. Link.

NEWS, DATA, AND HEADLINES

• Niron Magnetics broke ground on a 1,500-ton-per-year permanent magnet factory in Sartell, Minnesota, to manufacture permanent magnets from iron nitride instead of rare-earth materials, helping address U.S. supply chain vulnerabilities and accelerate electrification. Link.

• New England's last coal-burning power plant, the Merrimack station in New Hampshire, shut down after 65 years of operation. Link.

• Aurubis Richmond, a nearly $800 million recycling facility in Augusta, Georgia, began smelting common and rare minerals for reuse in electric vehicles, data centers, and energy infrastructure. Link.

• The EU unveiled a €545 million ($638 million) package to scale up renewables investment in Africa, including electrification support, grid modernization, and improved renewable access. Link.

• U.S. EV sales set a record in the three months before federal incentives expired, with Tesla and GM reporting significant year-over-year delivery increases as buyers scrambled to take advantage of expiring federal tax credits. Link.

• Meanwhile, BYD's monthly sales fell for the first time in more than 18 months amid fierce competition among electric vehicle makers in the Chinese market. Link.

• China published a national plan to promote large-scale energy storage, targeting 180 GW of installed capacity by the end of 2027—almost as much battery storage as the entire world has today. The plan aims to drive approximately $35.2 billion in direct project investment. China's installed BESS base at the end of 2024 totaled 73.8 GW/168 GWh, representing 130% year-over-year growth and about 40% of the global total. Link.

• BYD unveiled a 14.5 MWh single unit storage block using its 2710 Ah Blade cell—the biggest battery cell yet—designed for long duration energy storage with 70% reduction in system failure and maintenance costs compared to traditional designs. CATL also announced a 9MWh BESS earlier in the year. Link.

• PG&E announced plans to spend $73 billion on grid upgrades in California to meet surging data center demand. The investment follows Senate Bill 254, which expanded the state's wildfire fund by $18 billion and acknowledged that utilities can't carry the full burden of climate-driven wildfires when acting prudently. The utility had filed plans in March to build 700 miles of underground power lines and complete 500 miles of wildfire safety upgrades. Link.

• Carrier, the legacy air-conditioning giant, launched a new business venture putting batteries on central AC units that charge when energy is plentiful and power the appliances during grid stress. The company has installed the HVAC-connected batteries in 15 pilot households, with plans for more by year-end. The Electric Power Research Institute will document performance to prove the technology works at scale. Link.

• Nearly 450 hydroelectric stations totaling more than 16 gigawatts are scheduled for relicensing across the US over the next decade—roughly 40% of the nonfederal fleet. Many face costly upgrades for fish passage and wildlife protection, leading operators to surrender licenses rather than absorb expenses. Green Mountain Power shut down the Kelley's Falls Dam in New Hampshire last year after facing millions in upgrade requirements. Google's record-setting $3 billion contract with Brookfield for up to 3 GW of hydropower could help fund relicensing costs. Link.

• Duke Energy submitted a proposal to North Carolina regulators showing dramatically scaled-back clean energy ambitions after the state legislature nixed a key decarbonization deadline. The utility now plans about half as much wind and solar over the next decade, delays nuclear construction until later in the 2030s, and proposes 9.7-12.3 GW of new fossil fuel plants by 2035-2040. Battery storage increased by 1.5 GW. Link.

• A new Heatmap Pro poll found that most Americans say rising electricity prices have at least "a decent amount" of impact on household finances, and over 70% of voters earning under $50,000 said rising bills significantly impact spending, as did 62% earning under $100,000. Link.

• Electricity prices in U.S. areas near massive AI compute centers are also up as much as 267% compared to five years ago, according to a new report. Link.

• Sea ice in Antarctica reached its third-smallest winter peak extent since satellite records began 47 years ago—nearly 350,000 square miles below the 1981-2010 baseline. Link.

• Kemi Badenoch, leader of the British Conservatives, vowed to repeal the UK's Climate Change Act if her party wins the next election. The 2008 law, passed almost unanimously under a Tory government, has been "the cornerstone of green and energy policy" for 17 years. Former PM Theresa May, meanwhile, called it a "catastrophic mistake" that risks "many tens of billions of pounds." Link.

• A massive explosion and fire at Chevron's refinery in El Segundo brought "minutes of terror" to residents, lighting up the night sky. The refinery produces approximately one-fifth of Southern California's motor vehicle fuels and 40% of jet fuel. Residents expressed concerns about ongoing airborne toxins, with one noting occasional methane odors "hugging the grass." At least one worker claimed injury in a lawsuit filed Friday. Link.

• The Trump administration declared it would claw back $7.5 billion in federal grid funding, almost entirely from states that voted for Kamala Harris in 2024. DOE terminated 321 financial awards supporting 223 projects in 16 blue states, claiming they "did not adequately advance the nation's energy needs," though the partisan breakdown suggests otherwise. Similar projects in red states were not canceled, and the list includes 26 Grid Deployment Office grants for transmission, grid hardening, and microgrid projects. Link.

• The Trump administration also opened more than 13 million acres of federal land to coal mining leases and announced $625 million to upgrade, reopen, and "modernize" coal-fired power plants across the country. Link.

• California lawmakers cut funding for the Demand Side Grid Support program, the world's largest virtual power plant with over 1 gigawatt of grid-relief capacity (700 MW from batteries). Without new funding, companies may have to stop enrolling customers in 2026. Link.

• U.S. community solar installations fell 36% in the first half of 2025 compared to the same period last year. Link.

• The U.S. federal government shut down at 12:01 a.m. on Wednesday, after President Trump and Republicans failed to reach a budget deal with Democrats. There are several implications of the shutdown, including a slowdown in the EPA's deregulatory efforts, as well as the development of congressional permitting reform legislation. Other impacts include: nearly 90% of EPA staff being furloughed, the National Flood Insurance Program's ability to issue new policies lapsing, treasury work on tax credit rules for foreign components, and commerce investigations into solar tariff evasion being delayed. Link.

CURATED DEALS

Larger funding rounds:

• Einride, based out of Stockholm, raised $100 million at a $1+ billion valuation from investors including EQT Ventures and IonQ for its electric big rigs, autonomous freight pods, and logistics planning software. Link.

• Hyet Solaris, based out of Amsterdam, raised €60 million (~$70.2 million) from Aequitas Carbon and Abbeydale Partners for its ultra-lightweight, flexible solar modules. Link.

• Neptune Robotics, based out of Singapore, raised $52 million in Series B funding led by Granite Asia, with NYK Line participating, for its underwater robots that clean ship hulls (thereby making them more fuel efficient). Link.

• Phaidra, based out of Seattle, raised $50 million in Series B funding led by Collaborative Fund, with Helena, Index Ventures, Nvidia, and Sony Innovation Fund participating, for its AI platform that helps manage data center operations and energy usage. Link.

Medium-sized funding rounds:

• OXCCU, based out of Oxford, England, raised $28 million in Series B funding from Orlen VC, Safran Corporate Ventures, IAGi Ventures, Hostplus, and TCVC to convert waste carbon and green hydrogen into sustainable aviation fuel. Link.

• Unbound Potential, based out of Thalwil, Switzerland, raised €14 million (~$16.4 million) in one of Europe's largest pre-seed rounds from Founderful, Kvanted, another.vc, and Zürcher Kantonalbank to accelerate battery tech development. Link.

• kiutra, based out of Munich, Germany, raised €13 million (~$15.2 million) in equity funding co-led by NovaCapital and 55 North, with High-Tech Gründerfonds participating, for its helium-3-free cooling systems for quantum chips and computers. Link.

• Goodvest, based out of Paris, raised €12 million (~$14 million) in Series B funding led by Serena, with Ring Capital, Polytechnique Ventures, ALM Innovation, Globivest, and angels participating, for its Paris Agreement-aligned investment platform. Link.

• Electroflow, based out of San Bruno, California, raised $10 million seed round co-led by Union Square Ventures and Voyager to make lithium-iron-phosphate battery material more cheaply than Chinese producers by making anodes and essentially sticking them in brine to absorb lithium ions. Fifty Years and Harpoon Ventures participated. Link.

• Amber, based out of Melbourne, raised $10 million in equity funding from U.K. energy supplier E.ON Next and Virescent Ventures to expand its home battery and EV automation platform that optimizes energy use against real-time wholesale prices into overseas markets. Link.

• InOrbit.AI, based out of Mountain View, California, raised $10 million in Series A funding co-led by L'ATTITUDE Ventures and Globant Ventures for its platform designed to help manage robot fleets across manufacturing, logistics, retail, and hospitality. Link.

Smaller funding rounds

• Area 2 Farms, based out of Arlington, Virginia, raised $9 million in equity funding co-led by Slow Ventures and Seven Seven Six, with participation from ANIMO Ventures, for its local soil-based urban farms that shorten supply chains. Link.

• Anode, based out of San Francisco, raised $9 million in seed funding led by Eclipse for its mobile battery energy storage system technology that provides on-demand power as an alternative to diesel generators for utilities, data centers, contractors, and EV fleet operators. Link.

• Factor2 Energy, based out of Duisburg, Germany, raised €7.7 million (~$9 million) in seed funding led by At One Ventures for its CO₂-based geothermal power system. High-Tech Gründerfonds, Gründerfonds Ruhr, Verve Ventures, and Siemens Energy Ventures participated. Link.

• enaDyne, based out of Leipzig, Germany, raised €7 million (~$8.2 million) in seed funding co-led by Amadeus APEX Technology Fund and Energy Capital Ventures for its plasma-catalysis reactors that convert CO₂ into sustainable chemicals. Antares Ventures, Possible Ventures, and various angels participated. Link.

• sun.store, based out of Warsaw, secured €6 million (~$7 million) in seed funding co-led by Contrarian Ventures, Market One Capital, and Movens Capital for its B2B digital marketplace for solar, PV, and battery components across Europe. Link.

• Scindo, based out of London, raised €4.5 million (~$5.3 million) in equity funding co-led by Kadmos Capital and Clay Capital, with PINC, Synbioven, AgFunder, SOSV, Farvatn Venture, and Savantus Ventures participating, for its AI-driven enzyme discovery platform designed to make sustainable chemical alternatives. Link.

• Optimuse, based out of Vienna, raised €4 million (~$4.7 million) in seed funding co-led by seed + speed Ventures and Blum Ventures for its AI platform that optimizes building design to reduce costs and emissions. Matterwave Ventures and Gründungsfonds participated. Link.

• viboo, based out of Dübendorf, Switzerland, raised €3.3 million (~$3.9 million) in seed funding led by Realyze Ventures and Zürcher Kantonalbank to expand its AI-powered building energy efficiency platform into Germany. Link.

• Boldr, based out of London, raised $3.2 million in seed funding from Ada Ventures, Unconventional Ventures, Inclimo Climate Tech Fund, Prosegur, Techstars, S20 Fund, and Viva Holdings for its platform linking HVAC systems, EVs, batteries, and solar to the grid. Link.

Funds

• Norway's $2 trillion sovereign wealth fund committed $1.5 billion to Brookfield's energy transition fund. Link.

• Woven Capital, Toyota's growth fund, launched a second $800 million fund to invest across mobility, energy, AI, and climate. Toyota also set up a $670 million strategic arm called Toyota Invention Partners to back Japan-based startups from the ground up. Link (paywall). Link.

• Serena, based out of Paris, raised €200 million (~$234 million) for its fourth flagship fund to finance startups in applied AI and the energy transition. Link.

• C4 Ventures, based out of Paris, launched its third €100 million (~$117 million) fund to back early-stage AI and deep tech startups across Europe in robotics, quantum computing, and AI semiconductors. Link.

• Wave Function Ventures, based out of San Francisco, raised a $15.1 million debut fund to back early-stage deep tech startups in nuclear energy, robotics, and aerospace. Link.

Ciao,

— Nick

Reply