- Keep Cool

- Posts

- Affordability is king

Affordability is king

Plus lots more across energy and sustainability circles

Hi,

I was in New Mexico to watch a friend’s play over the weekend—lovely state! Fun fact: Ten counties in the Permian Basin, including some in this, the Land of Enchantment, account for more than 90% of new oil production growth since 2020 in the U.S. Not something I think most folks know. Then again, I don’t think most folks appreciate that the U.S. is the world’s largest oil and gas producer in general.

Anyway, here’s what caught my eye across energy and sustainability circles this week.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

ONE STORY IN A SENTENCE AND A CHART

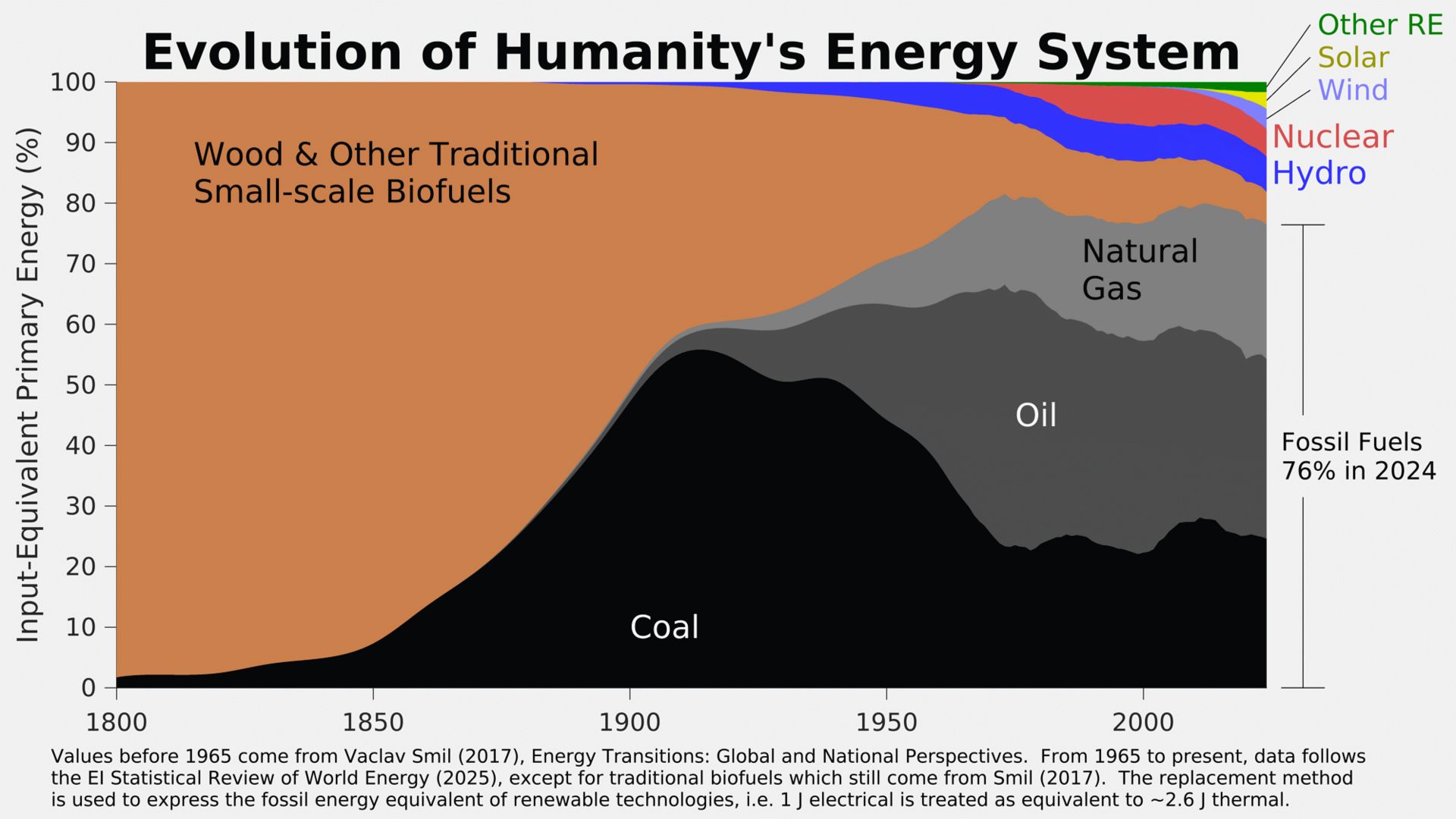

• While global greenhouse gas emissions have yet to peak, the percentage share of global energy production owned by fossil fuels has meaningfully plateaued, and actually crested a bit back down to 1960s levels. Link.

NEWS, DATA, AND HEADLINES

• New projections show the world is on track for 2.8°C of warming above preindustrial times by 2100, well above the 1.5°C Paris Agreement commitment. Both Rhodium Group and the UN Environment Programme reached similar projections, noting that Trump administration policies are being offset by plummeting renewable costs and continued climate action in other countries. Link. Link.

• Redwood Materials started up its $3.5 billion South Carolina factory, which has the capacity to recycle 20,000 metric tons of critical minerals from old EV batteries. The company also opened a recycling plant in Sparks, Nevada, at which it hopes to collect 60,000 tons of minerals annually. Link.

• Bloomberg Philanthropies will provide $100 million in new funding to expand Carbon Mapper's satellite tracking of methane emissions and support policy reforms in Australia, Indonesia, Mexico, Nigeria, and other countries, as well as nine U.S. states, to better target and advance methane emissions mitigation strategies. Link.

• T1 Energy's Dallas factory set a new production record of 14 MW of solar panels in a single day, a pace that would represent a 5.1 GW annualized production rate. Link.

• The U.S. Energy Information Administration reports that solar and wind provided nearly 40% of Texas' power in 2025 so far, enabling the grid to accommodate record levels of demand. Link.

• Democrats Abigail Spanberger and Mikie Sherrill won the Virginia and New Jersey governor's races and will seek to fulfill promises on keeping down electricity costs, which emerged as a chief voter concern. Spanberger's "Affordable Virginia" plan includes cutting construction red tape, making data centers cover their power costs, and building rooftop solar with battery storage. Sherrill vowed to declare a "state of emergency on utility costs" on her first day, freeze utility rates, and "immediately develop plans for new nuclear capacity" in Salem County. She also accused PJM Interconnection of "mismanagement" and giving preference to coal and oil. Link.

• Zohran Mamdani won the New York City mayoral race, inheriting Local Law 97, which requires nearly 50,000 buildings over 25,000 square feet to slash emissions 40% by 2030 and reach net-zero by 2050 by swapping oil and gas heating for electric heat pumps. More than 50% of covered buildings will need to make changes to hit the 2030 target. Otherwise, throughout his long mayoral campaign, Zohran Mamdani rarely spoke about climate change, despite defining himself through climate activism during his early state legislature career. Link.

• Illinois passed the Clean and Reliable Grid Affordability Act, calling for procurement of 3 gigawatts of energy storage by 2030. The bill also creates a virtual power-plant program, makes geothermal eligible for state renewable incentives, and lifts a decades-old moratorium on large nuclear plant construction. Link.

• Colorado expanded its Vehicle Exchange Colorado EV rebate program, increasing rebates from $6,000 to $9,000 for new EV purchases and leases, and from $4,000 to $6,000 for used EVs. The state now leads the nation in EV sales, with EVs making up 32.5% of new car sales in Q3 2025, the highest market share ever recorded in the U.S. Link.

• The EPA quietly walked back plans to eliminate Energy Star, the program that costs $32 million annually but saves Americans more than $40 billion each year. The agency renewed four contracts with ICF, the consulting firm that helps oversee the program, including one deal that stretches through September 2030. Affordability is king! Link.

• French hydrogen investor Hy24 is providing funding to Stegra (formerly H2 Green Steel), Europe's flagship green-steel project, which faces a capital shortfall of $1+ billion. Construction is 60% complete on the facility in northern Sweden, which, if completed, would become the world's first large-scale steel mill fueled by clean hydrogen. Link.

• The liquid cooling space for data centers saw multiple acquisitions this week, with Vertiv Holdings acquiring PurgeRite, a provider of mechanical flushing, purging and filtration services for data centers, for approximately $1.0 billion in cash plus potential additional consideration of up to $250 million based on 2026 performance metrics, and Eaton signing an agreement to acquire the Boyd Thermal business from Goldman Sachs Asset Management for $9.5 billion. Boyd Thermal is a leader in thermal components and liquid cooling solutions for data centers, with forecasted sales of $1.7 billion for 2026, of which $1.5 billion is in liquid cooling. Link. Link.

• Heineken, Rondo Energy, and EDP contracted to deploy a 100 MWh Rondo Heat Battery at Heineken’s Portugal brewery to provide continuous renewable steam for brewing processes, charged by on-site solar and grid renewables under a Heat-as-a-Service model. Link.

• The White House announced no "high-level representatives" will attend COP30 in Brazil, with President Trump "directly engaging" with world leaders on energy through trade frameworks instead. EU Climate Commissioner Wopke Hoekstra said the lack of participation by the "most important geopolitical player" clearly "does damage." Link.

• The four largest cloud providers—Amazon, Microsoft, Google, and Meta—reported tens of millions of dollars in federal lobbying in 2025 alone as data center companies spark a boom in Beltway influence-peddling. Meta hired 21 more lobbyists this year than last, and OpenAI has increased its lobbyists nearly sevenfold since 2023. In parallel, a Heatmap poll found only 44% of Americans would welcome a data center near their homes. Link. Link.

• Kia confirmed it has indefinitely delayed plans to bring the EV4 sedan to the U.S. The Korean automaker had showcased the model at the New York Auto Show in April. Link.

• Glaciologists recorded a five-mile retreat in just two months on the Hektoria Glacier on the Antarctic Peninsula, nearly 10 times faster than previously measured for a grounded glacier. Grounded glaciers typically retreat less than 1,000 feet per year, but the glacier retreated nearly half a mile per day at some points between November and December 2022. If Thwaites or Pine Island glaciers began breaking apart at this rate, sea level rise would accelerate dramatically. Link.

CURATED DEALS

Larger funding rounds:

• Vulcan Elements, based out of Durham County, North Carolina, secured over $1 billion in financing from the federal government and private investors to kick-start its first large-scale rare-earth magnet production factory in the U.S. Link.

• Beta Technologies—which is based out of Burlington, Vermont, and builds electric aircraft, including eVTOLs—saw its valuation climb to $7.4 billion as it raised $1 billion in its NYSE debut. Link.

• Armis, based out of San Francisco, raised a $435 million round at a $6.1 billion post-money valuation for its security software for critical infrastructure. Goldman Sachs Alternatives led with Evolution Equity Partners and CapitalG also participating. Link.

• Infravision, based out of Austin, Texas, raised $91 million in Series B funding led by GIC to make drones and robots to automate grid construction. Activate Capital, Hitachi Ventures, and Energy Impact Partners also invested. Link.

• Upway, based out of Gennevilliers, France, raised a $60 million Series C round for its refurbished e-bike marketplace. Link.

• The Every Company, based out of Daly City, California, raised $55 million in Series D funding led by McWin Capital Partners to expand manufacturing of its precision-fermented egg proteins following a nationwide Walmart rollout. Link.

Medium-sized funding rounds:

• LanzaTech, based out of Skokie, Illinois, secured €40 million (~$46.4 million) via an EU Innovation Fund Grant to build a first-of-its-kind integrated CCUS project in Norway. Link.

• EO Charging, based out of Stowmarket, U.K., raised £25 million (~$29 million) in equity funding to make charging hardware and software for commercial EV fleets. Zouk Capital, Vortex Energy, and HSBC participated. Link.

• Synonym, based out of New York, announced a $20 million Series A and a partnership with Brenntag, the world's largest chemical distributor, on a program called "Better with Bio" designed to help companies accelerate the commercialization of biobased products in cosmetics, personal care, and home goods. Link.

• Source.ag, based out of Amsterdam, raised €15.2 million (~$17.6 million) in a Series B round led by Astanor, with participation from Enza Zaden and Harvest House, to scale its AI software for ‘Controlled Environment Agriculture.’ Its software is already in use in 300 greenhouses across 18 countries. Link.

• Avnos, based out of Los Angeles, raised $17 million in project finance from Shell and Mitsubishi Corp. to build a "commercial demonstration" plant that can remove 3,000 tons of CO2 and produce 6,000 tons of clean water annually in the U.S. The company says its "moisture swing" process requires less energy than traditional direct air capture methods. It has raised over $100 million in total. Link.

• Fairmat, based out of Paris, raised a €10 million (~$11.6 million) Series B extension led by Infinity Recycling to expand its circular materials technology into the construction and energy sectors. Link.

• Hullbot, based out of Sydney, Australia, raised $10.6 million in a Series A funding round led by Regeneration VC—with support from Climate Tech Partners, Katapult Ocean, Folklore, Trinity Ventures, Rypples, NewSouth Innovations, and Bandera Capital—to scale production of its autonomous boat hull-cleaning robots. Link.

• Quino Energy, based out of San Leandro, California, closed a $10 million Series A funding round from Atri Energy Transition to scale production of its water-based organic flow battery electrolyte beyond the U.S., with an option to call on an additional $6 million for a total investment of up to $16 million. Link.

Smaller funding rounds:

• Terranova, based out of Berkeley, California, raised $7 million in seed funding co-led by Congruent Ventures and Outlander to build autonomous robots to inject wood slurry underground to lift and stabilize flood-prone land. GoAhead Ventures, Gothams, and Ponderosa also participated. Link.

• Btry Ag, based out of Dübendorf, Switzerland, raised €4.9 million (~$5.7 million) in seed funding led by Redstone VC—and joined by Bloomhaus Ventures, Linear Capital, Kickfund, Kick Foundation, Leopold König, Torge Thönnessen, High-Tech Gründerfonds, and Zürcher Kantonalbank—to develop fast-charging solid-state lithium batteries Link.

• Adaptronics, based out of Milan, Italy, raised a €3.15 million (~$3.7 million) Series A round led by 360 Capital to build energy-efficient electro-adhesive robotic grippers with tactile sensing. Link.

• DREV, based out of Gothenburg, Sweden, secured €2.8 million (~$3.2 million) seed funding co-led by Butterfly Ventures and Almi Invest GreenTech, for its Vault contamination control systems which capture hazardous "black dust" in battery manufacturing and can recover useful minerals in the process. S-E-Bankens Utvecklingsstiftelse and Battle Born Venture also participated. Link.

• Cambridge Photon Technology, based out of Cambridge, U.K., raised £1.56 million (~$1.9 million) to advance its photon-multiplier technology, which boosts solar panel efficiency by converting wasted sunlight into usable infrared light without requiring panel redesigns. Link.

Not saying how much rounds:

• Carbon Direct is acquiring Pachama, a major player in the nature-based carbon credits market, to augment its scientific expertise with Pachama's proprietary technology for forest carbon project monitoring, reporting, and verification. Terms weren't disclosed. The deal comes as tech giants, airlines, and banks seek high-quality credits to meet decarbonization goals amid growing AI data center power demand. Link.

Funds:

• Lowercarbon Capital, based out of San Francisco, is raising a second, larger fund to invest in nuclear fusion startups, following its $250 million fusion-focused fund from 2022 and existing bets on Commonwealth Fusion Systems and Pacific Fusion. Link.

• Forbion, based out of Naarden, Netherlands, closed its €200 million (~$232 million) BioEconomy Fund I, with backing from KfW Capital, Novo Holdings, Rentenbank, Aurae Impact, ABN AMRO Bank, and EIFO, to support biotech-driven innovations in food, agriculture, materials, and environmental technologies. Link.

• Rubio Impact Ventures, based out of Amsterdam, raised over €70 million (~$81.2 million) for its third impact fund, backed by the European Investment Fund, Invest-NL, ING, NN Social Innovation Fund, and Dutch entrepreneurs and families, to invest in 30 companies addressing climate change and social inequality. Link.

Adios,

— Nick

Reply