- Keep Cool

- Posts

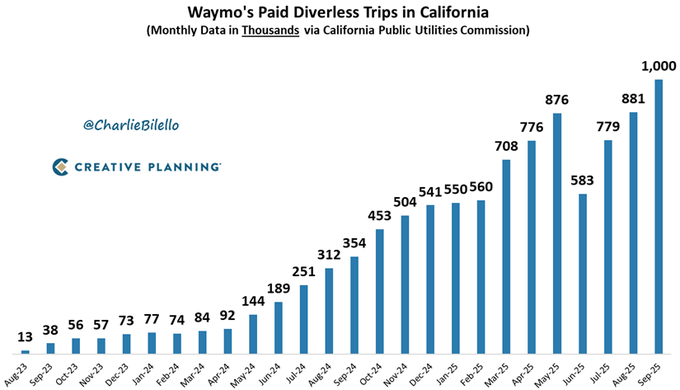

- 1 mil Waymo rides (per month)

1 mil Waymo rides (per month)

Plus lots more across energy and sustainability circles

Hey hey,

Hope those of you in the U.S. enjoyed the holiday. And that those of you not in the U.S. are gearing up and excited for those to come. This week’s post constitutes a roundup of the last two weeks of November, as I skipped last week’s. Happy December!

Invest in Renewable Energy Projects Across America

Across America, communities are being powered thanks to investors on Climatize who have committed to a brighter future.

Climatize lists vetted renewable energy investment offerings in different states.

As of November 2025, over $13.2 million has been invested across 28 projects on the platform, and over $3.6 million has already been returned to our growing community of thousands of members. Returns aren’t guaranteed, and past performance does not predict future results.

On Climatize, you can explore vetted clean energy offerings, including past projects like solar farms in Tennessee, grid-scale battery storage units in New York, and EV chargers in California. Each offering is reviewed for transparency and provides a clear view of how clean energy takes shape.

Investors can access clean energy projects from $10 through Climatize. Through Climatize, you can see and hear about the end impact of your money in our POWERED by Climatize stories.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

ONE STORY IN A SENTENCE AND A CHART

• Waymo has now hit the 1 million rides per month threshold I predicted it would last year, this year (and in California alone, no less). Link.

NEWS, DATA, AND HEADLINES

• The U.S. government plans to buy and own as many as 10 new, large nuclear reactors as part of a larger push to meet surging demand for electricity. The new details of the unusual arrangement were outlined last Month by Carl Coe, the Energy Department’s chief of staff, including details regarding the non-binding commitment made by Japan in October to fund $550 billion in U.S. projects, including as much as $80 billion for the construction of new reactors made by Westinghouse. Link.

• The Department of Energy’s Loan Programs Office just announced a $1 billion loan to finance Microsoft’s restart of the functional Unit 1 reactor at the Three Mile Island nuclear plant. The funding will go to Constellation, the station’s owner, and cover the majority of the estimated $1.6 billion restart cost. If successful, it’ll likely be the nation’s second-ever reactor restart, assuming Holtec International’s revival of the Palisades nuclear plant goes as planned in the next few months. While the Trump administration has rebranded several loans brokered under its predecessor, this marks the first completely new deal sanctioned by the Trump-era LPO, a sign of Energy Secretary Chris Wright’s recent pledge to focus funding on nuclear projects. It’s also the first-ever LPO loan to reach conditional commitment and financial close on the same day. Link.

• Meanwhile, China’s march toward dominance in atomic energy continues at a steady pace. The country poured the first concrete for two new nuclear power stations, NucNet reported. The start of the new projects put Beijing closer to its ambitious goal to reach 70 gigawatts of installed reactor capacity, up from 55 gigawatts at last count, by the end of this year. China is expected to fall slightly short of the target, but it’s on track to meet the goal by the early part of next year. Link.

• China National Nuclear Corporation, one of the two major state-owned atomic power utilities in the country, also announced that Unit 2 of its Zhangzhou nuclear plant is officially hooked up to the grid, World Nuclear News reported. It’s the second of six planned reactors, based on the Chinese-designed Hualong One model, at the same location in Fujian province. Link.

• Rainmaker has begun the most extensive cloud seeding campaign in modern U.S. history. The El Segundo-based startup is operating across 7,500 square miles of Utah and Idaho in the Bear River Basin. The company aims to revitalize the Great Salt Lake, a critical water source for residents, agriculture, ranching, and the region’s broader economy. Link.

• LanzaJet began full commercial operations at its Freedom Pines Fuels plant in Georgia, becoming the first company in the world to produce on-spec jet fuel from ethanol at scale. Although 18 months late, the milestone caps 15 years of development of its Alcohol-to-Jet technology and gives the green light to FID for the rest of its project pipeline. Link.

• First Solar announced plans to invest $330 million to build a South Carolina factory to manufacture solar modules, with commercial operations set to begin in late 2026. Link.

• Zap Energy unveiled its latest fusion device, the Fuze-3, which achieved a plasma pressure of over 232,000 psi and temperatures exceeding 21 million °F as the company advances toward commercial fusion power in the early 2030s. Link.

• The Sentinel‑6B satellite, equipped with a U.K.-built propulsion system, launched last month to monitor global sea levels for the Copernicus Programme, enhancing climate resilience and coastal protection worldwide. Link.

• Ebb, based out of South San Francisco, CA, partnered with Saudi Arabia's Water Authority to decarbonize desalination at scale, targeting megaton-level CO₂ removal within the next decade while improving freshwater recovery across Saudi facilities that account for 22% of global desalination capacity, with initial deployment at SWA's research facility in Jubail using Ebb's electrochemical system to convert desalination brine into caustic soda, hydrochloric acid, and low-salinity brine while enabling up to 85 megatonnes of CO₂ removal annually. Link.

• The state of Parà in Brazil will soon require all cattle to be tagged electronically to trace where they came from in order to be sold legally and to slow deforestation. Link.

• Sales of pure internal combustion engine cars peaked worldwide in 2017 and have since fallen by 30%, while EV sales increased 14-fold over the same period, according to the International Energy Agency’s latest report. Link.

• U.S. EV sales, meanwhile, plunged an estimated 49% (!!) in October from September's record levels, as federal tax credits expired, per Cox Automotive data. Link.

• Waymo recently announced that its autonomous robotaxi service will be available to the public in five new cities — Miami, Dallas, Houston, San Antonio, and Orlando — beginning next year. Waymo’s service is currently operating in five markets — the Bay Area, Austin, Phoenix, Los Angeles, and Atlanta — with a total of 12 others in the pipeline for expansion, though the market is pricing in three cities available in the Waymo One app by the end of this year. Link.

• Bolt also announced a new partnership with China’s Pony AI to bring self-driving taxis to Europe, coupled with a stated target aim of having vehicles on streets by 2027. Link.

• China approved the lowest amount of new coal power capacity in the first three quarters of 2025, potentially putting Beijing on track to hit its power-sector emissions peak this year as capacity additions fall for a second consecutive year. Renewables have accounted for 59% of total installed power capacity between 2021 and 2025. Link.

• Over the last three years, California has generated more electricity from utility-scale solar farms while generation from natural gas-fired plants dropped. Gas still dominates the state’s power generation, but industrial solar generation more than doubled in the first eight months of 2025 compared to the same period in 2020, new analysis from the federal Energy Information Administration found. Between January and August of this year, natural gas supplied 18% less power than during the same months five years ago. Link.

• Denmark’s climate minister, Lars Aagaard, announced that his government would submit a binding target to cut emissions by 82% by 2035 compared with 1990 levels. That’s one percentage point higher than the U.K. goal set out earlier this year, eeking out the top spot for most ambitious near-term decarbonization target. Link.

• Iran is facing six consecutive years of drought with rainfall 85% below average and key reservoirs depleting, driven by temperatures rising 1.5°C+ since the 1970s, along with groundwater mismanagement, water-intensive crop subsidies, and excessive dam building. Authorities are rationing water in parts of Tehran with pressure dipping at night, and the president has flagged evacuating the capital's 10 million residents as a last resort. The country will also test cloud seeding despite its uncertain effectiveness. Link.

• Russian scientists reportedly asked the Kremlin to fund a feasibility study on a $100 billion plastic pipeline to divert water from Russia's Ob river through Kazakhstan into Uzbekistan, carrying up to 22 cubic km of water annually, building on a similar Soviet-era proposal to replenish the Aral Sea basin while offering Putin potential leverage over Central Asia's efforts to break from Moscow's orbit. Link.

• The COP30 climate summit in Brazil concluded without an explicit new international mandate to drive the global transition away from fossil fuels, instead creating a "global implementation accelerator" voluntary initiative to coordinate climate plans and report progress at COP31 in Turkey next year. Meh! Link.

• FERC approved NRG Energy’s plan to buy a 13 GW fleet of gas-fired power plants, which would roughly double its electricity generation. In other words: U.S. natural gas consumption ain’t going anywhere quickly. Link.

• Redwood Materials, the battery recycling startup led by Tesla co-founder JB Straubel, cut dozens of workers as the company scales back some of its projects to focus on tapping into demand for grid-scale batteries, Bloomberg reported Tuesday. The layoffs took place this month and were spread across the company, amounting to up to 6% of the total workforce. Redwood is now focusing on repurposing old batteries for the grid and extracting critical minerals from scrapped power packs. Link.

• Heidelberg Materials paused its flagship CCS project at the Slite cement plant after Sweden’s Energy Agency rejected its bid for co-funding under the Industrial Step program. The decision stalls a retrofit that would have cut Sweden’s emissions by 1.8 Mt per year and, more importantly, reflects project risk for lower carbon cement alternatives as low cement prices threaten momentum for decarbonization in the “hard-to-abate” sector. Link.

• Rio Tinto shelved its $3 billion Jadar lithium project in Serbia after years of political pushback, stalled permitting, and rising costs, ending Europe’s best shot at securing a major domestic lithium mine. The pause deepens the EU’s supply-chain gap for lithium and other metals, leaving it even more dependent on future imports. Link.

• New York state paused enforcement of its landmark all-electric building code until a federal appeals court rules on a lawsuit challenging the state’s gas ban. The delay marks a reversal for Gov. Kathy Hochul, who argues the pause could prevent a longer legal freeze and still lead to a green light eventually, even as critics say it undermines climate commitments and follows other recent decisions favoring fossil fuels. Link.

• Anti-nuclear-power groups file a federal lawsuit to halt the restart of the Palisades nuclear plant in Michigan, arguing that the proposal should not have been permitted after the owner planned to close the facility permanently. Link.

• Nearly one-fifth of the Environmental Protection Agency’s workforce opted into President Donald Trump’s mass resignation plan, according to new data obtained by E&E News. The agency had 16,155 employees at the start of this year. As of the end of September, the EPA’s payroll included 15,166 employees, according to data released during the government shutdown, meaning that more than 2,620 employees accepted the “deferred resignation” offer. Link.

• The Environmental Protection Agency proposed stripping federal protections from millions of acres of wetlands and streams. The New York Times cast the stakes of the rollback as “potentially threatening sources of clean drinking water for millions of Americans” while delivering “a victory for a range of business interests that have lobbied to scale back the Clean Water Act of 1972, including farmers, home builders, real estate developers, oil drillers and petrochemical manufacturers.” Link.

CURATED DEALS

Larger funding rounds:

• X-energy, based out of Rockville, MD, raised a $700 million Series D funding round led by Jane Street to develop advanced small modular nuclear reactors and proprietary fuel. ARK Invest, Galvanize, Hood River Capital Management, Point72, Reaves Asset Management, XTX Ventures, Ares Management funds, Corner Capital, Emerson Collective, NGP, and Segra Capital Management also invested. Link.

• HoloSolis, based out of Hambach, France, raised over €220 million (~$255.2 million) in public and private funding backed by investors including Calés Technologie, Forming, InnoEnergy, TSE, Groupe IDEC, Armor Group, and Heraeus to build one of Europe’s largest solar cell and module gigafactories in Sarreguemines-Hambach, targeting 5 GW annual capacity. Link.

• Turing, based out of Tokyo, raised a $63.2 million Series A funding round at a $388 million post-money valuation led by Denso to develop fully self-driving automotive systems. GMO Internet Group and Global Brain also participated. The company also raised $35.4 million in debt. Link.

• Amperesand, based out of Singapore, raised an $80 million Series A funding round co-led by Walden Catalyst Ventures and Temasek to make medium voltage solid-state transformer power systems. Industry Ventures, Acclimate Ventures, and SG Growth Capital, plus previous investors Xora Innovation, Material Impact, TDK Ventures, and Foothill Ventures, also participated. Link.

• Gridware, based out of San Francisco startup raised $55 million in Series B funding co-led by Tiger Global and Generation Investment Management to make that -monitoring technology for utilities. Sequoia, Convective Capital, Fifty Years, True Ventures, Lowercarbon, and Y Combinator also invested. Link.

• Nanoramic, based out of Woburn, MA, raised $54 million in equity funding co-led by General Motors Ventures and Catalus Capital to develop and commercialize battery technologies for higher-density, lower-cost energy storage applications. PEP Capital, Samsung Ventures, Top Material, ITOCHU Corporation, Fortistar Capital, and WindSail Capital Group also participated. Link.

Medium-sized funding rounds:

• Overstory, based out of Amsterdam, raised $43 million in Series B funding to provide tools for utilities to monitor and manage vegetation that could threaten power lines or other grid assets. Blume Equity led, with additional participation from Energy Impact Partners and previous investors, including B Capital, Semapa Next, Pale Blue Dot, CapitalT, Convective Capital, Bentley Systems, MCJ, and Moxxie Ventures. More here. Link.

• Flocean, based out of Oslo, raised $22.5 million in Series A extension funding led by Xylem to develop subsea desalination systems using deep-ocean pressure to produce low-carbon freshwater. Burnt Island Ventures, Freebird Capital, Katapult Ocean, Nysnø Climate Investments, Ari Emanuel, Orion, Rypples, and the Water Unite Impact Fund also invested. Link.

• nextProtein, based out of Paris, raised ~$20.9 million (€18 million) in Series B funding led by SWEN Capital Partners and British International Investment to open a second facility in Tunisia and scale production of its insect-based protein ingredients. Link.

• Sortera, based out of Austin, TX, raised $20 million in equity and $25 million in debt funding led by VXI Capital, T. Rowe Price–advised accounts, Overlay Capital, Yamaha Motor Ventures, and Trinity Capital to build a second aluminum-sorting plant for its AI technology stack designed to enable more profitable metal recycling at scale. Link.

• Amogy, based out of New York, raised $15 million in equity funding led by GS Engineering & Construction for its ammonia-to-power systems for transportation applications. XPLOR and GS Futures also participated. Link.

• Bone AI, based out of Seoul and Palo Alto, raised a $12 million seed round led by Third Prime to develop autonomous air, ground, and marine vehicles. Link.

• PowerUP Energy Technologies, based out of Tallinn, Estonia, raised ~$11.6 million (€10 million) in Series A funding co-led by Mercaton and ScaleWolf, with participation from SmartCap Green Fund, to scale manufacturing and commercial deployment of its hydrogen fuel cell generators for dual-use civilian and defence applications. Link.

• Hammerhead AI, based out of Redwood City, CA, launched out of stealth with a $10 million seed round to do TK. Buoyant Ventures led the round, and Schneider Electric's VC arm, Aina Climate AI Ventures, MCJ Collective, WovenEarth Ventures, and other individuals invested. Link.

Smaller funding rounds:

• Ruminant BioTech, based out of Auckland, New Zealand, raised a $9.5 million Series A round co-led by Rosrain Investments and Cultivate Ventures to make a slow-release bolus for methane-inhibiting solutions that reduce methane emissions in pasture-raised cattle. Marex and AgriZeroNZ also invested. Link.

• Pionix, based out of Bad Schönborn, Germany, raised €8 million (~$9.3 million) in equity funding led by Ascend Capital Partners with participation from Start-up BW Seed Fonds, Pale blue dot, and others to build an open-source EV charging system. Link.

• Voltrac, based out of Valencia, Spain, raised an $8.1 million seed round led by Extantia to build autonomous electric tractors for agricultural and logistics use. FoodLabs, Antler, PUSH, and Prototype Capital also invested. Link.

• Rhizocore Technologies, based out of Edinburgh, Scotland, raised £4.5 million (~$6 million) in equity funding led by The First Thirty to scale production of its RhizoPellet™ mycorrhizal fungal technology, which is designed to improve tree survival and growth. The funds will support expansion into the North American reforestation market. Link.

• NexDash, based out of Berlin, raised ~$5.7 million in seed funding led by Extantia Capital, with Clean Energy Ventures also anteing up, to build software to coordinate electric truck fleets and charging operations. Link.

• Maritime Fusion, based out of San Francisco, raised $4.5 million in a seed funding round led by Trucks VC, with Aera VC, Alumni Ventures, Paul Graham, Y Combinator, and others, to develop a ship-based tokamak fusion reactor, aiming to bring clean maritime power online in the early 2030s. Link.

• Delta Charge, based out of Sweden and Germany, closed an oversubscribed funding round to the tune of €3.7 million (~$4.3 million). The round was led by Vireo Ventures and Rethink Ventures, with participation from Audi and Allianz executives, German family offices, and Munich ClimateTech founders. It will use the funds to scale its pan-European electric truck charging and battery storage network. Link.

• Nordic Salt Cycle, based out of Copenhagen, raised €3.5 million (~$4 million) in pre-seed funding from EIFO, The Footprint Firm, and Ananda Impact Ventures to commercialise its patented molten salt technology for scalable, low-cost recovery of critical minerals from end-of-life batteries and other products. Link.

• Athian, based out of Indianapolis, raised $4 million in Series A funding to help livestock producers cut greenhouse gas emissions and generate Scope 3-aligned credits by adopting “science-based sustainability practices.” Investors included noteworthy companies like Chipotle Mondelēz International Sustainable Futures, California Dairies, Elanco Animal Health, dsm-firmenich Ventures, Newtrient, and Tyson Ventures. Link.

• Ponda, based out of London, raised €2.09 million (~$2.4 million) in seed funding co-led by Faber and Counteract, with participation from PDS Ventures, Evenlode Impact, and the Royal College of Art, to commercialise its regenerative plant-based insulation “BioPuff.” Link.

• Installio, based out of London, raised £1.5 million (~$2 million) in seed funding in a round led by Verb Ventures to support its national rollout of heat pumps and to enable high-quality, scalable retrofit installations across the U.K. Link.

• MetroElectro, an Australian commercial solar startup, raised $1 million in equity from Wavemaker Impact and secured a $4 million debt facility from Ecotone Partners to scale its rooftop solar and battery systems, designed for use in industrial and commercial buildings without upfront costs. Link.

• Planet Smart, based out of London, raised $1 million in pre-seed funding from General Inception, Vertical Venture Partners, Innovate UK, and Undaunted Accelerator to further develop PlanetSorb, a biodegradable super-absorbent polymer for sanitary products that breaks down in six months without microplastics. Link.

• Plentify, based out of Cape Town, South Africa, raised an undisclosed amount of Series A funding led by Secha Capital, Buffet Investments, and a South African family office to scale its AI-powered home-energy management platform. E3 Capital, Fireball Capital, Endeavor’s Harvest Fund, and Satgana also invested. Link.

Funds:

• Future Energy Ventures, based out of Berlin, closed its €205 million (~$237.8 million) Fund I to scale digital, asset-light technologies driving the global energy transition. Link.

• Al Gore’s Generation Investment Management raised $200 million for a new strategy that targets the restoration of land degraded by farming and deforestation. Just Climate, which was established by Generation in 2021, got allocations from investors including Royal Bank of Canada, Achmea Investment Management, and the Environment Agency Pension Fund. The money will be deployed in its natural climate solutions initiative, and comes on top of $175 million raised earlier this year. Link.

• EIT Urban Mobility, based out of Barcelona, committed up to €44 million (~$51 million) over the next three years to continue investing in scalable, socially beneficial urban mobility innovations across Europe. Link.

Till next time,

— Nick

Reply